Did You Know?: Bank of England Founded by Pirate Gold

The Bank of England (sometimes abbreviated simply as BOE) could probably claim the title of most prestigious central bank in the world with little argument. It has been in operation for over 300 years, founded in 1694. Few outsiders may realize that the bank began, and spent most of its history, as a private corporation.

This begs some interesting questions. How was it founded? By whom? The answers are quite surprising. What isn't surprising is the fact that gold is at the center of this story.

Humble Beginnings Lead to Big Payoffs

The intriguing story of the Bank of England starts with a certain Sir William Phips, who was actually born in the colonies, in Maine. Phips, like his father, was a shipwright—a ship builder. Phips followed his entrepreneurial spirit to England to secure funding for treasure-hunting voyages.

In reality, Phips was little more than a pirate. (The same is true of the famous English "hero," Sir Francis Drake.) Even though most of his ventures were disappointing failures, Phips was not discouraged. He garnered the financial backing of the Duke of Albermarle. This duke was known to be of ill repute with his fellow aristocrats due to his preference for gambling. This actually made him the perfect candidate to support Phip's far-fetched ideas.

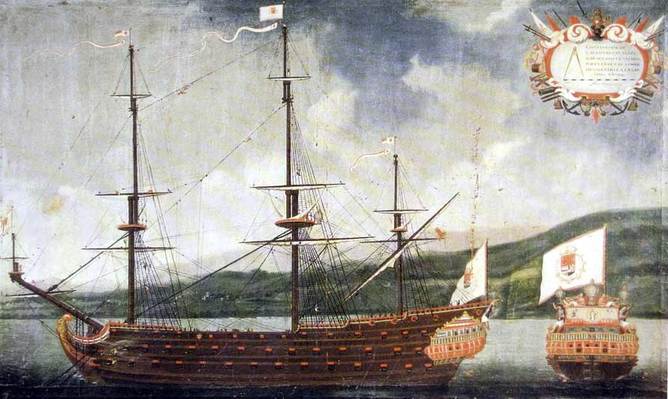

Using primitive submarines, Phips and his crew went in search of the famous Nuestra Señora de la Concepción (Our Lady of the Conception). This Spanish ship, loaded with gold and silver bullion, had sunk in waters near the Bahamas some 50 years prior.

According to reports, "the galleon was elusive—[Phips and] his crew searched in vain and finally in January 1687, Phips gave the order that they were to head for home, empty-handed."

However, by a stroke of luck, divers happened upon a cannonball in a dense coral reef. Nearby, the Nuestra Señora was found!

Stolen Treasure Gives Birth to the Bank of England

The ship's booty clocked in at 34 metric tonnes of gold and silver, an impressive haul. Investors in the long-shot venture received 10,000 percent dividends. One of those investors was William Paterson, another self-made buccaneer.

Paterson used his portion of the loot as a seed for plans of a new private bank to fund King William III's navy to protect British trade routes on the high seas, especially against the despised French.

The booty from the Nuestra Señora not only flooded England with bullion, making a bank more of a necessity, but also was held up as an example to entice others to invest in the new bank. A staggering £1.2 million (equivalent to about £1 billion in terms of today's money) was raised for the project.

This project for a new bank, built on the back of looted Spanish treasure, became the Bank of England in 1694. It did not become a part of the national government until 1946. This is when the progeny of the original private investors were finally paid interest on their initial investments, an unbelievable 420,000 percent gain!

Martin Parker, a Professor at the University of Leicester and author for The Conversation, sums it up like this:

"But it is worth remembering that the vaunted institution that is the Bank of England, which now seems timeless and above reproach, began as a projection—a speculative attempt to make a quick buck. This is how the very idea of a 'national debt' began—a speculation and promise that has now grown to £2 trillion for the UK."

So next time you hear the [Bank of England's] governor Mark Carney speak, remember that his position was born from a storm that caused a Spanish shipwreck on a coral reef in 1641, carrying treasure stolen from South America."

Everett Millman

Everett has been the head content writer and market analyst at Gainesville Coins since 2013. He has a background in History and is deeply interested in how gold and silver have historically fit into the financial system.

In addition to blogging, Everett's work has been featured in Reuters, CNN Business, Bloomberg Radio, TD Ameritrade Network, CoinWeek, and has been referenced by the Washington Post.